Why is quantitative finance important?

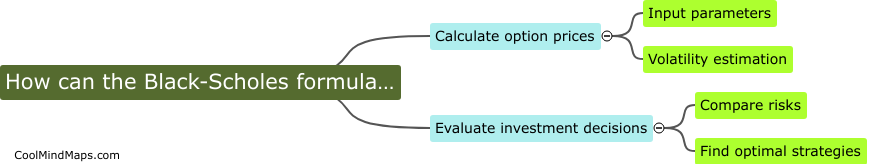

Quantitative finance is important because it utilizes mathematical and statistical models to analyze financial markets, manage risk, and make investment decisions. By using data-driven strategies, quantitative finance professionals can identify patterns, trends, and opportunities in the market that may not be apparent through traditional methods. This analytical approach can help investors optimize their portfolios, minimize risks, and potentially achieve higher returns. Additionally, quantitative finance also plays a crucial role in the development of new financial products and trading algorithms, driving innovation and efficiency in the global financial markets.

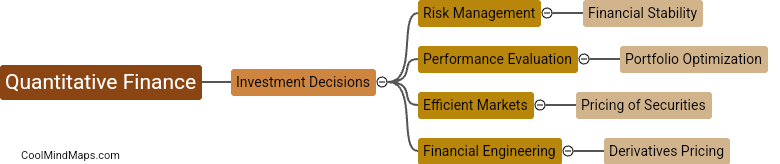

This mind map was published on 2 April 2024 and has been viewed 61 times.