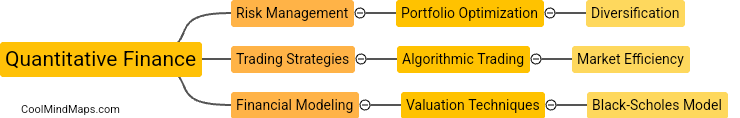

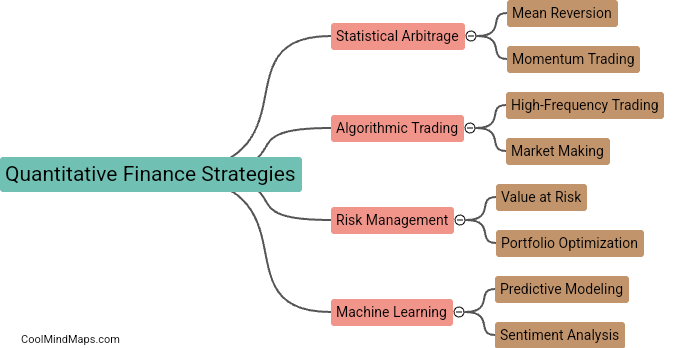

What are some common quantitative finance strategies?

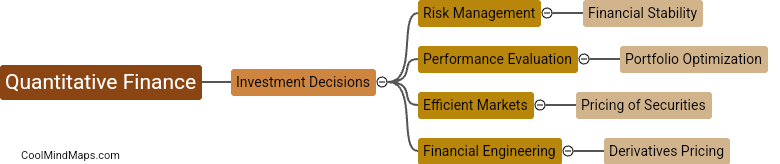

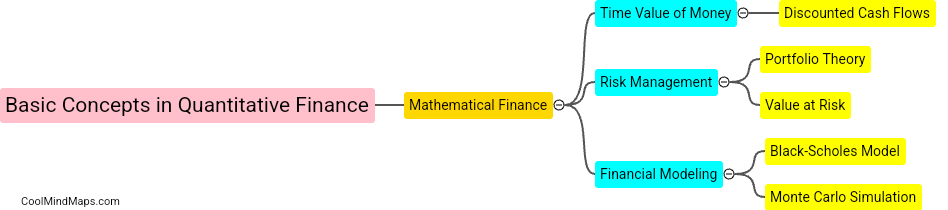

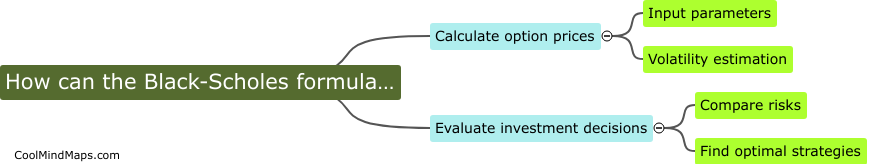

Some common quantitative finance strategies include algorithmic trading, statistical arbitrage, and risk management. Algorithmic trading involves using computer algorithms to execute trades quickly and efficiently based on predefined rules. Statistical arbitrage involves identifying mispriced securities by analyzing statistical relationships between different assets and profiting from those discrepancies. Risk management strategies involve minimizing potential losses by diversifying investments, using stop-loss orders, and calculating value at risk. These quantitative strategies aim to generate consistent returns by leveraging data, technology, and mathematical models to make informed investment decisions.

This mind map was published on 2 April 2024 and has been viewed 42 times.