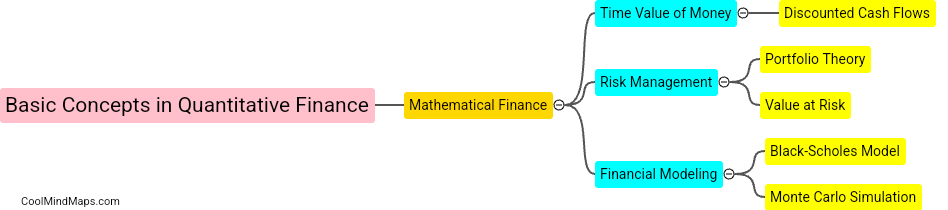

What are the basic concepts in quantitative finance?

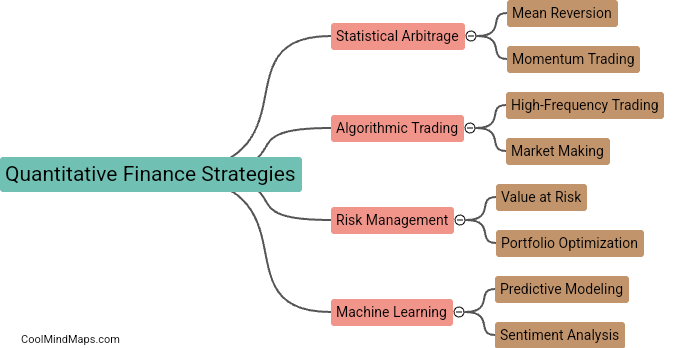

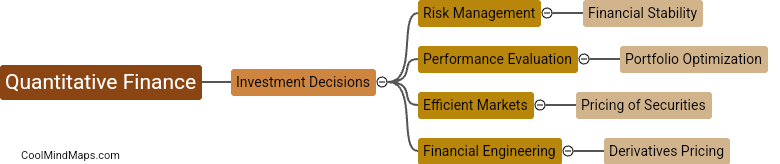

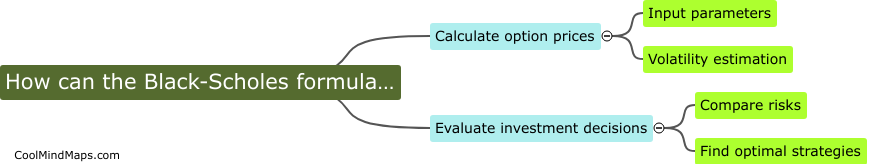

Quantitative finance involves the use of mathematical models and statistical analysis to understand and predict financial markets. Some basic concepts in quantitative finance include pricing models such as the Black-Scholes model for options, risk management techniques like Value at Risk (VaR) calculations, and portfolio optimization strategies such as Modern Portfolio Theory. Other key concepts include time value of money, probability theory, and regression analysis. These tools and concepts help financial professionals make informed decisions about investing, hedging, and managing risk in the financial markets.

This mind map was published on 2 April 2024 and has been viewed 78 times.