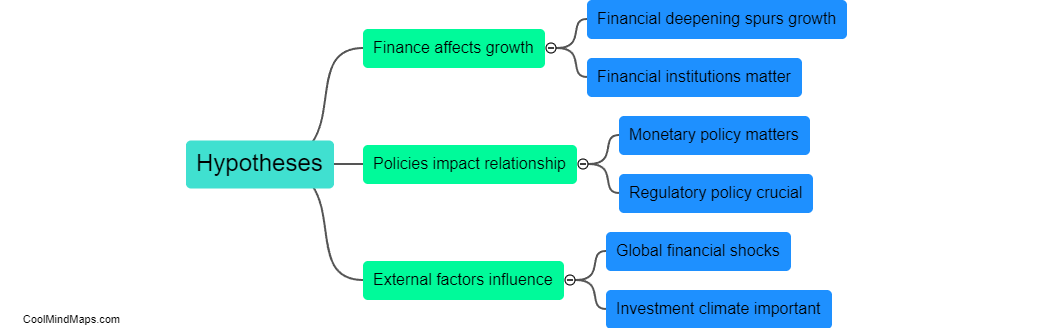

Are there specific hypotheses that explain the nexus between financial development and economic growth?

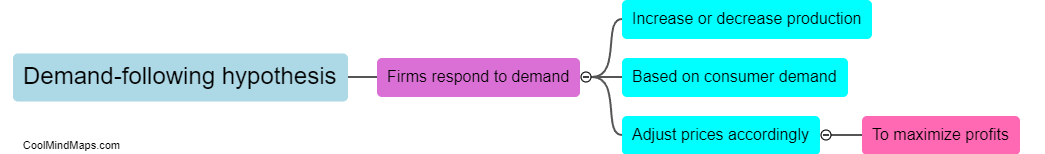

There are a few specific hypotheses that attempt to explain the relationship between financial development and economic growth. One hypothesis is the supply-leading hypothesis, which suggests that a well-developed financial system can provide the necessary capital for investment, leading to increased productivity and economic growth. Another hypothesis is the demand-following hypothesis, which posits that economic growth drives the need for a more sophisticated financial system to facilitate the allocation of resources and investment. Additionally, the finance-growth nexus theory argues that financial development and economic growth are interdependent, with each one influencing and reinforcing the other in a virtuous cycle. Overall, the relationship between financial development and economic growth is complex and multifaceted, with various hypotheses offering insights into how they may be interconnected.

This mind map was published on 25 April 2024 and has been viewed 27 times.