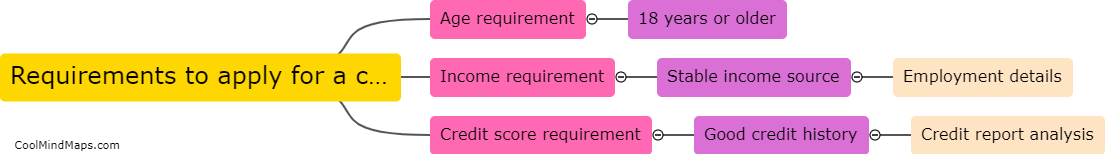

What are the requirements to apply for a credit card?

To apply for a credit card, individuals typically need to meet certain requirements set by the credit card provider. Some common requirements include being at least 18 years old, having a steady source of income, and a good credit score. Applicants may also need to provide personal information such as their name, address, Social Security number, and employment details. Additionally, some credit card issuers may require applicants to have a certain level of income or a minimum credit score to qualify for specific types of credit cards. Meeting these requirements can help increase the chances of approval when applying for a credit card.

This mind map was published on 2 April 2024 and has been viewed 85 times.