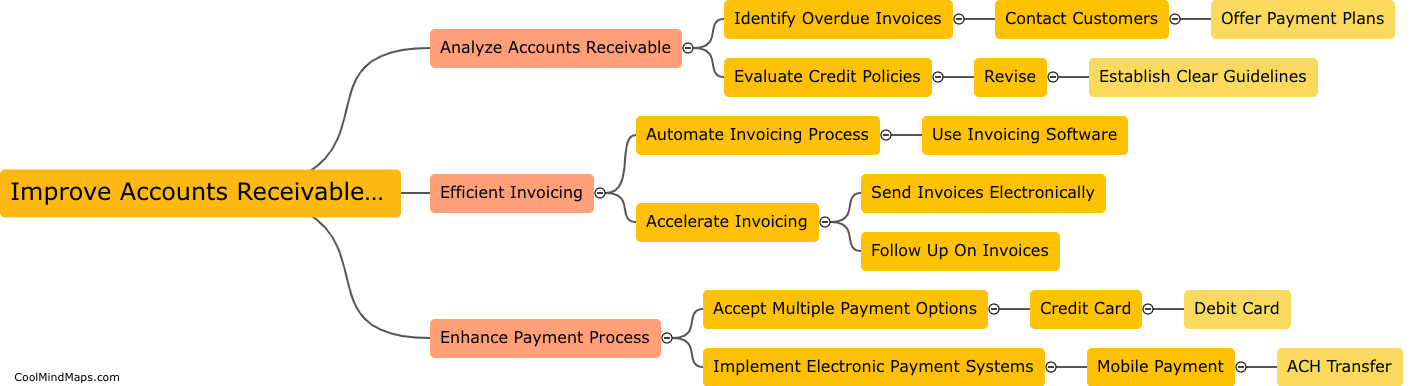

How to improve accounts receivable turnover?

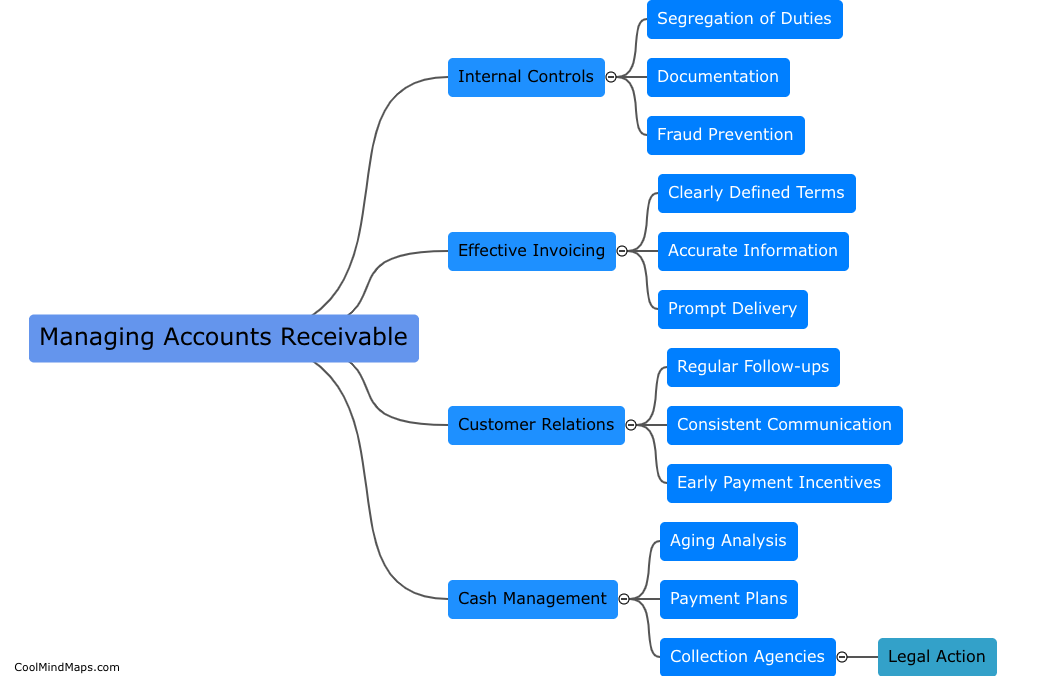

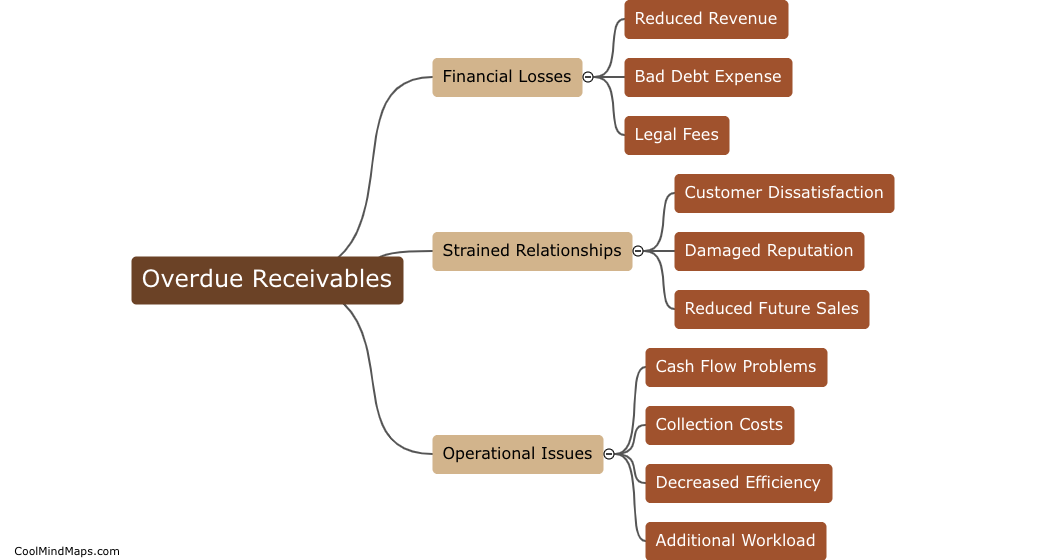

Accounts receivable turnover is a crucial financial metric that measures how efficient a company is at collecting cash from its customers. A low accounts receivable turnover can signify cash flow issues and can create liquidity problems, which can ultimately hurt a business. To improve accounts receivable turnover, businesses can implement strategies such as tightening credit policies, offering discounts for customers who pay early, providing online payment options, and improving communication with customers about payment deadlines. It is also essential to have an effective collections process for overdue payments, including regular follow-up and communication with customers. By implementing these strategies, businesses can improve their accounts receivable turnover and maintain a healthy cash flow.

This mind map was published on 24 April 2023 and has been viewed 59 times.