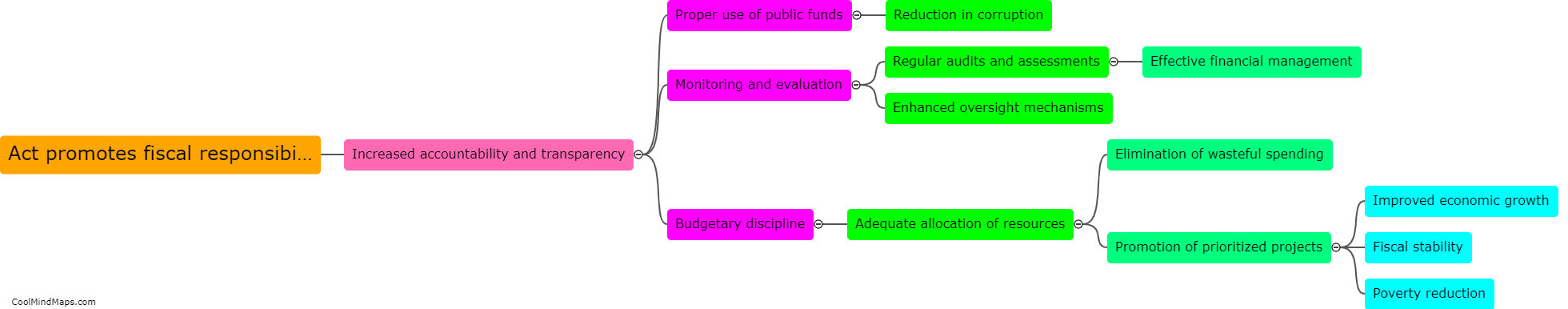

How does the Act promote fiscal responsibility in Nepal?

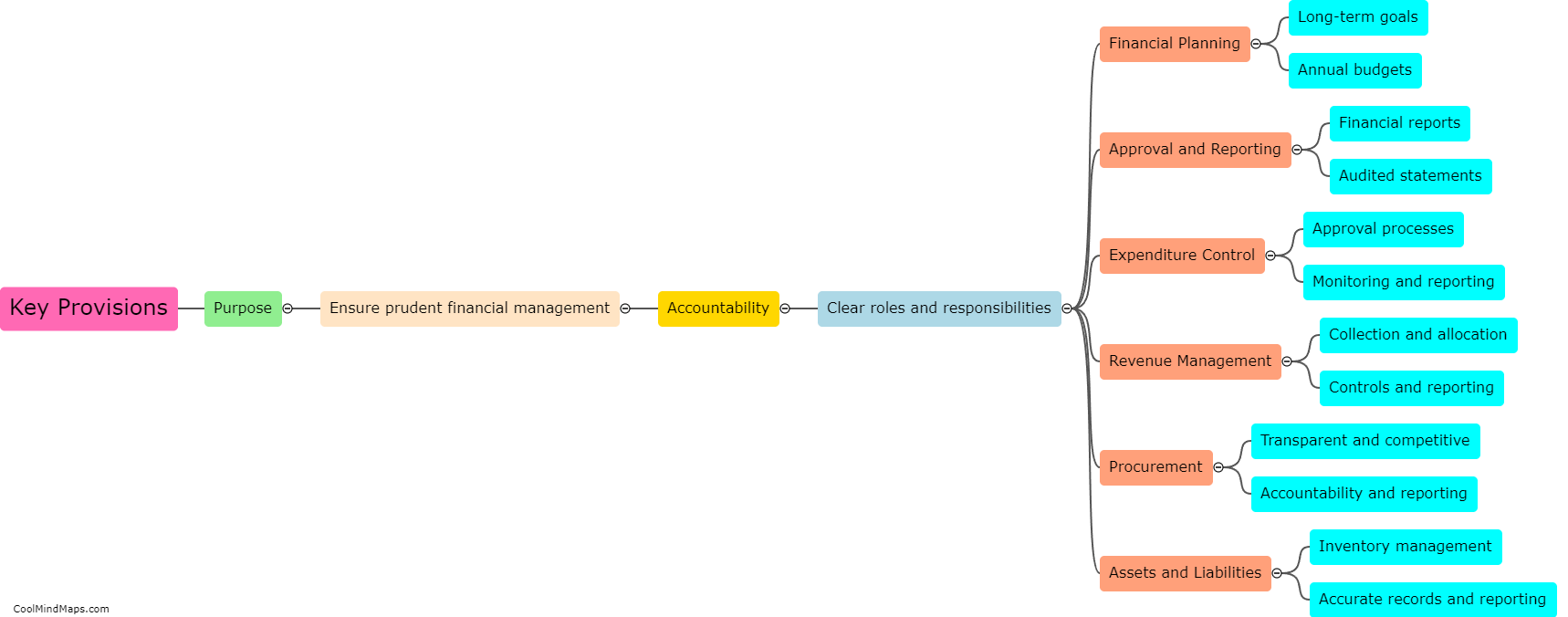

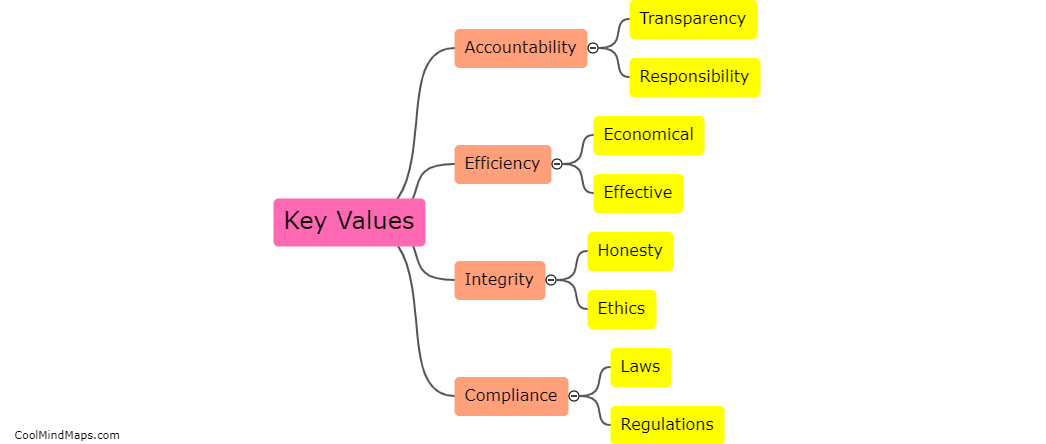

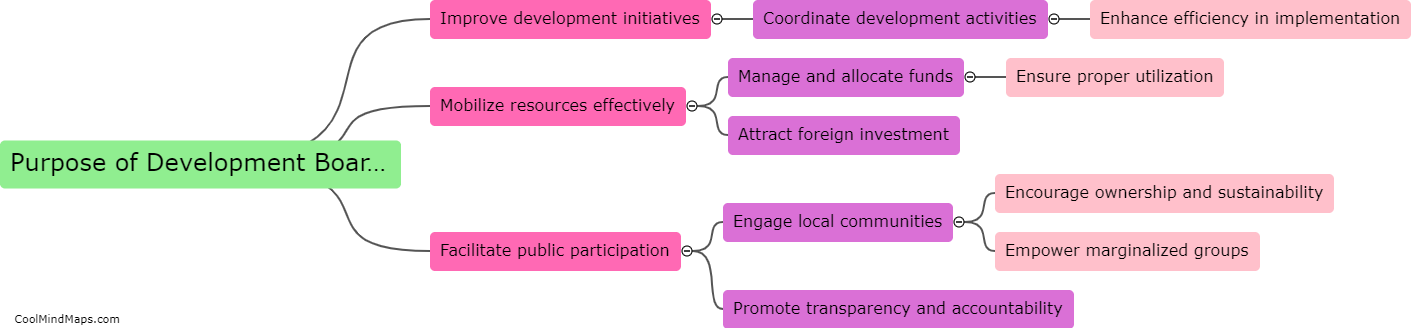

The Act promotes fiscal responsibility in Nepal through various mechanisms. Firstly, it establishes a framework for fiscal planning and management, ensuring that government spending is aligned with the country's economic objectives. This helps to prevent excessive borrowing and debt accumulation, as the Act sets limits on deficits and debts that the government can incur. Additionally, the Act promotes transparency and accountability in public financial management by requiring regular reporting and auditing of government accounts. It also encourages the development of sound budgetary practices, such as performance-based budgeting, to ensure that public funds are utilized efficiently and effectively. Ultimately, by promoting fiscal responsibility, the Act aims to create a stable and sustainable fiscal environment that supports economic growth and development in Nepal.

This mind map was published on 26 November 2023 and has been viewed 105 times.