How can traders manage risk when trading pullbacks?

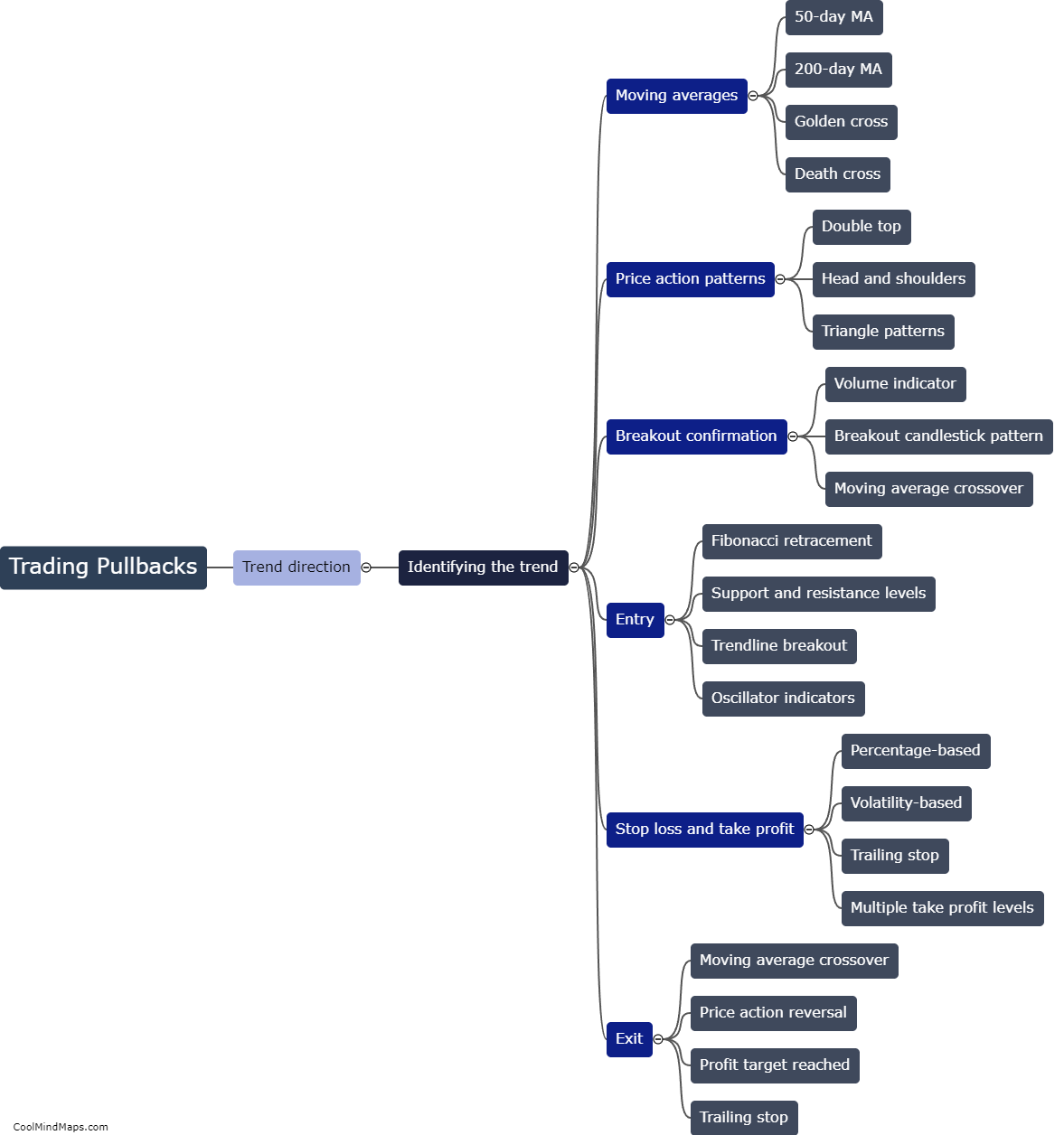

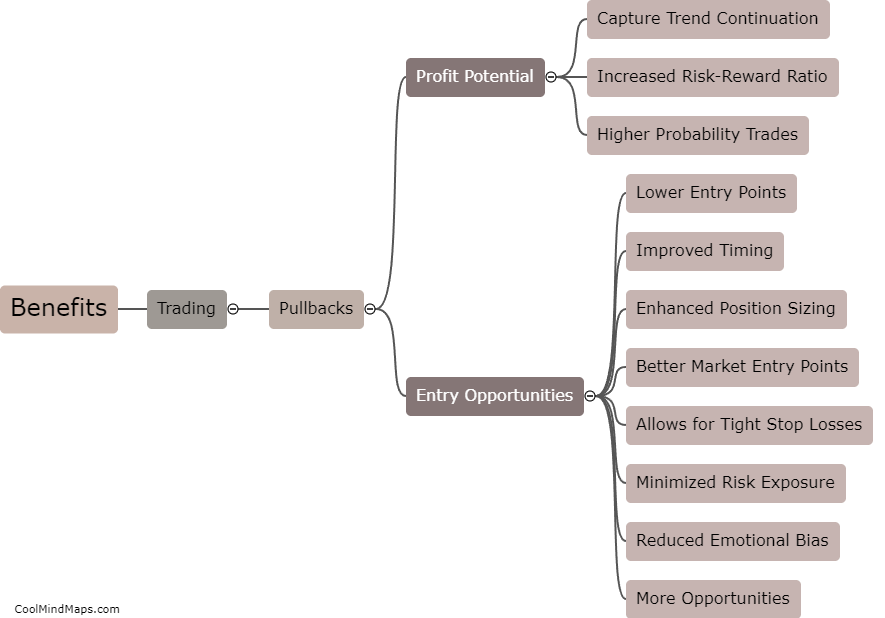

When trading pullbacks, one of the crucial aspects to consider is risk management. Traders can adopt several strategies to effectively manage risk during these market movements. Firstly, setting a clear stop-loss order can help limit potential losses if the price retracement turns into a downward trend. Additionally, traders can calculate their risk-reward ratio to ensure they are adequately compensated for the risk they are taking. Utilizing trailing stop-loss orders can also be an effective way to protect profits and secure gains if the price reverses during the pullback. Employing proper position sizing techniques, such as risking a certain percentage of capital per trade, can further mitigate risk and prevent excessive losses if the pullback extends beyond expectations. It is essential for traders to understand and implement these risk management strategies to navigate the inherently uncertain nature of trading pullbacks.

This mind map was published on 4 August 2023 and has been viewed 129 times.